Fraudulent Unemployment Claims

Due to the rise in unemployment insurance claims related to COVID-19, there has been a rise in fraudulent unemployment claims and other instances of fraud. The fraudulent claims involve unemployment claims filed using another person’s identity. Most often awareness of a fraudulent claim will start when CSU’s third party vendor receives the claim and reaches out to CSU Human Resources who help to identify if this is a fraudulent claim.

As many as 400,000 Coloradoans have been affected by fraudulent unemployment claims, including several hundred State employees. This is a nationwide issue, and there is no evidence that this is the result of any State action but rather a series of breaches by private companies over the last couple of years. See a glimpse of the magnitude and seriousness in this article.

The Colorado Department of Labor and Employment (CDLE) is monitoring the situation and working closely with Department of Personnel & Administration (DPA) and Human Resources departments to notify victims that their identities have been compromised.

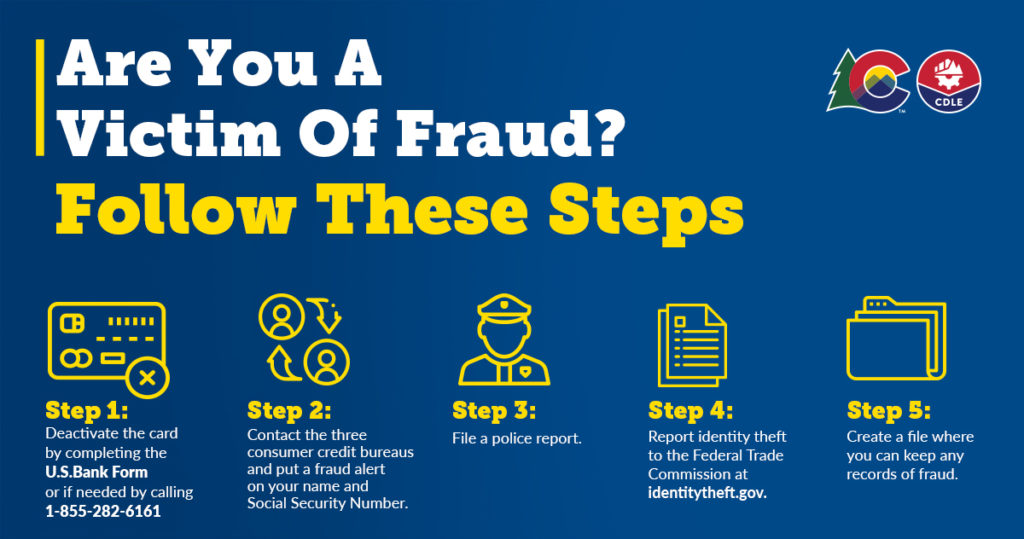

In Colorado, many victims have discovered this after receiving a U.S. Bank Reliacard debit card, 1099-G or other paperwork from CDLE but have not filed a claim. If this applies to you, report it to CDLE and follow the five steps outlined below. Employees outside of Colorado will need to contact their applicable state agency. A list of state agencies can be found here.

Resources

Contact

- Email: hr_records@mail.colostate.edu

- Phone: 970-491-6947

- Fax: 970-491-6302

- Address: 555 S. Howes Street Fort Collins, CO 80523-6004

What to do if you believe someone is using your identity to collect unemployment benefits:

- If you received a U.S. Bank Reliacard but did not file a claim, please fill out the U.S. Bank Form and contact U.S. Bank immediately at 1-855-282-6161. Inform them that a fraudulent unemployment claim was filed on your behalf and ask them to deactivate the card.

- Please remember to contact your state agency to report fraud.

- You can get a free credit report from Equifax, Experian and TransUnion at www.annualcreditreport.com or call 1-877-322-8228. You will report to the credit bureaus that the fraudulent claim was made using your identity and provide them with the case number from your police report (see step 3). You can have a fraud alert put on your identity or freeze your credit. Doing either is free by law.

- A fraud alert is free and will make it harder for someone to open new accounts in your name. To place a fraud alert, contact one of the three credit bureaus. That company must tell the other two.

- Equifax: 1-888-766-0008

- Experian: 1-888-397-3742

- TransUnion: 1-800-680-7289

- It is advised for individuals to check their credit activity at least once a year. A victim of identity theft has a right to check it monthly if they choose.

- Credit Freeze – If you decide to freeze your credit you can learn more at the FTC Consumer Identify Credit Freeze site.

- You should file an online or non-emergency report with the law enforcement agency in the jurisdiction in which you reside.

- You should also file an Identity Theft report with the Federal Trade Commission (FTC) via their online form at www.identitytheft.gov.

- The FTC has materials available about how to respond to, limit the damage from, and start recovering from identity theft. You can find useful and reassuring resources at the FTC Consumer Information Identity Theft site and www.identitytheft.gov.

Hang on to any notes, copies of emails, etc. This is the paper trail that you can reference if you face any identity issues or locate inaccuracies sometime in the future.

Tax Form 1099-G

If you received a 1099-G document from the Colorado Department of Labor and Employment but did not file a claim for unemployment benefits, you may be a victim of identify theft. Please follow the below steps if this applies to you.

Report it to the Colorado Department of Labor and Employment using the Report Invalid 1099 form.

Contact the three consumer credit bureaus and put a fraud alert on your name and Social Security Number.

- Equifax: 1-800-525-6285

- Experian: 1-888-397-3742

- TransUnion: 1-800-680-7289

File a counter report with your local police department to have a record on file.

Hang on to any notes, copies of emails, etc. This is the paper trail that you can reference if you face any identity issues or locate inaccuracies sometime in the future.

Protect Yourself Against Fraud

Never give out personally identifiable information over the phone. The Colorado Department of Labor and Employment will never contact you and ask for your social security number, bank account numbers, your PIN, account passwords, or any other personally identifiable information.