Understanding Your Pay Advice

CSU uses a paperless system for all pay advice information. Employees can view and print their pay advice in Employee Self-Service. Information about pre and after tax deductions can be found here.

Instructions for the Payslip Modeler can be found here.

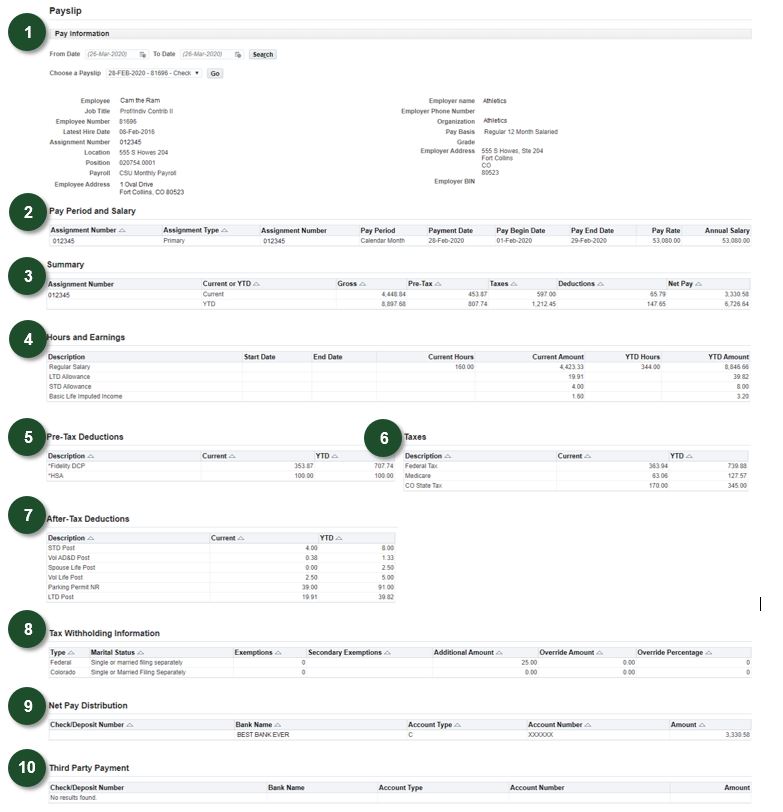

Sample Pay Advice

- Section 1: Pay Information: Contains pay period information and pay date, personal information as well as work location. The highlighted sections are the following: CSU email address, your social security number, your CSU employee number, your assignment number, your home address, employer name and organization is current department and your work address.

- Section 2: Pay Period & Salary: Contains your assignment number, your assignment type, whether you are paid biweekly or monthly (this example is monthly), the pay date, the pay period begin and end dates, your pay rate and annual salary (in this example both are indicating the yearly rate).

- Section 3: Summary: Contains your assignment number and then two lines; one is indicating this particular pay period amounts and the line directly below indicates the Year-To-Date amounts for the same categories of gross income, pre-tax deductions, obligatory taxes, additional deductions and net pay.

- Section 4: Hours and Earnings: Contains the number of hours and types of hours you are being paid for (current hours) and the amount for each category (current amount). Also included are the Year-To-Date hours and Year-To-Date amounts for each of the categories. If you earn overtime or have sick or vacation time entered, then these would show separately under description.

- Section 5: Pre-Tax Deductions: Contains any pre-tax deductions (deductions taken prior to taxation) you have elected which may include flexible spending accounts, insurance benefits, retirement accounts, etc. This will include the current pay period amount as well as the Year-To-Date amount.

- Section 6: Taxes: Contains mandatory tax deductions for current pay period as well as the Year-To-Date amount. *As of July 2023, the FAMLI tax for the state of Colorado will be deducted. The name of the deduction on your pay advice is State Misc2 Withheld (CO). Employees working in a state other than Colorado may have State Misc2 Withheld if the work state requires a municipality tax.

- Section 7: After-Tax Deductions: Contains the listing of any after-tax deductions you have elected which include parking and some benefit deductions. This will include the current deduction for the pay period and the Year-To-Date total amount deducted.

- Section 8: Tax Withholding Information: Contains your federal and state filing status including any additional amount you have elected to send to the corresponding tax agency(ies).

- Section 9: Net Pay Distribution: Contains your direct deposit information including bank name whether or not your account is a Checking or Savings account, your account number is xxxx’d out except for the final four digits and the amount of the deposit for this pay period.

- Section 10: Third Party Payment: Contains information for Third Party pay such as garnishments, levies, child support, student loan garnishment, etc. If your income is garnished by a legal entity, then the information pertaining to the payee and the amount deducted from your pay would appear here.