FY23 State Classified Pay and Leave Changes FAQ

Compensatory time payouts

When compensatory time is paid out upon termination, transfer, the end of the fiscal year, or upon mutual agreement, the rate of pay for the payout calculation now includes premium pay from the previous workweek, including shift differential, on call pay, holiday premium pay, etc.

How exactly is the new compensatory time payout rate calculated?

Total compensation in the work week (except for statutory exclusions) divided by total hours worked in the workweek equals pay rate for the work week.

On-call pay

The on call rate increased to $5 per hour effective July 1. An employee in an on-call status who performs work will receive a minimum of two hours pay or the actual hours worked, if greater.

Call back pay

If employee called back in to work, will receive regular rate or overtime (if applicable) for hours worked or a minimum of two hours pay, whichever is greater. This is unchanged.

How will TimeClock Plus help manage call back?

A new call back job code available to eligible employees automatically applies the minimum of two hours or the amount of time worked. More information available here.

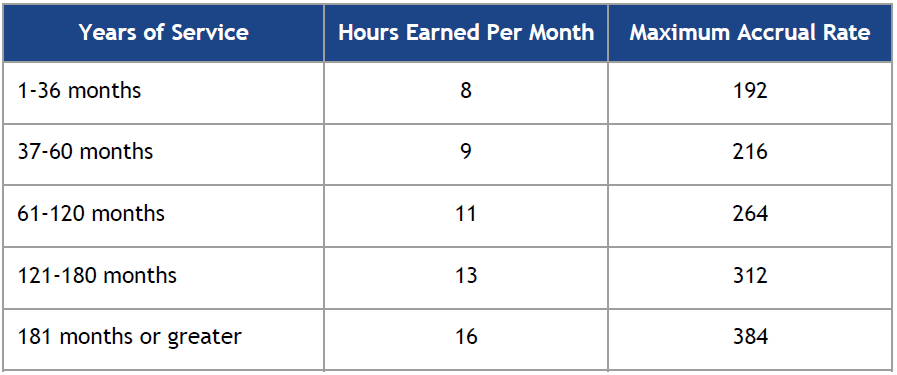

Annual leave accruals

A new tier has been added to monthly annual leave accrual rates and maximums, and most of the accrual rates and maximums have been increased. Maximum rates remain at the equivalent of two years worth of accruals. The new rates are:

Premium pay for work on observed holidays

If a non-exempt state classified employee is scheduled and required to work on an observed holiday, that employee shall be granted an alternative day off in the same fiscal year, or will be paid at 1.5 times their normal pay rate for all hours worked on that state observed holiday or earn the equivalent compensatory time (four hours of compensatory time earned for eight hours worked, for instance). A weekend shift rate has been added for eligible classifications.

How will TimeClock Plus help manage premium pay for work on holidays?

A new job code called, “SC Holiday Work x1.5,” is available for non-exempt state classified employees to use. More information available here.

Shift differential changes

The schedule for determining shift differential (premium pay earned for working after normal University hours of operation) is changing for weekend shift.

- Second shift differential of 7.5% shall be paid for all hours worked when half or more of the scheduled work hours fall between 4 p.m. and 11 p.m. Monday through Thursday.

- Third shift differential of 14% shall be paid for all hours worked when half or more of the scheduled work hours fall between 11 p.m. and 6 a.m. Monday through Thursday.

- Weekend shift differential of 20% shall be paid for all hours worked when more than half of the scheduled shift hours fall on a weekend shift that starts at 4 p.m. Friday evening through 6 a.m. Monday morning.

Previously, separate shift differential percentages and schedule existed for health care employees. The same shift differential plan applies to all eligible state classified employees effective July 1. Shift differential eligible classifications are determined by the state of Colorado and can be viewed on their website.

Will TimeClock Plus accurately reflect the new shift differential plan?

Effective July 1, shift differential is applied according to the new plan for state classified employees in eligible classifications.

Is anything else in TimeClock Plus changing in July?

To accommodate some of the changes outlined above, the Timesheet available to monthly employees in TimeClock Plus had to be changed to a time-in/time-out sheet instead of a time in and number of hours.

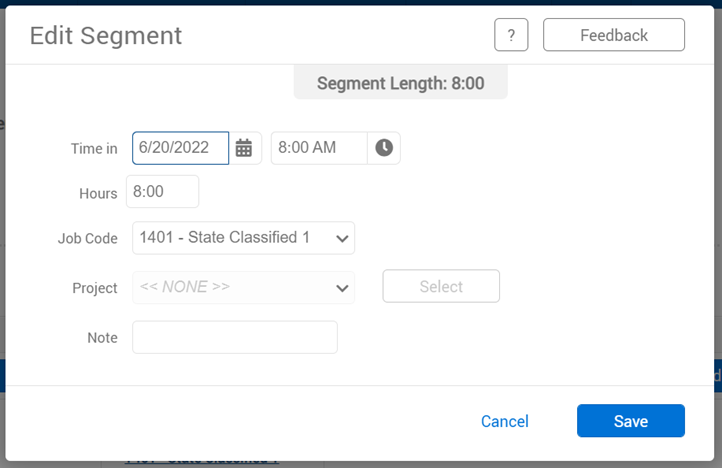

The previous version of the timesheet allowed for a time and number of hours worked. The timesheet now requires a time in and specific time out for all non-exempt state classified employees.

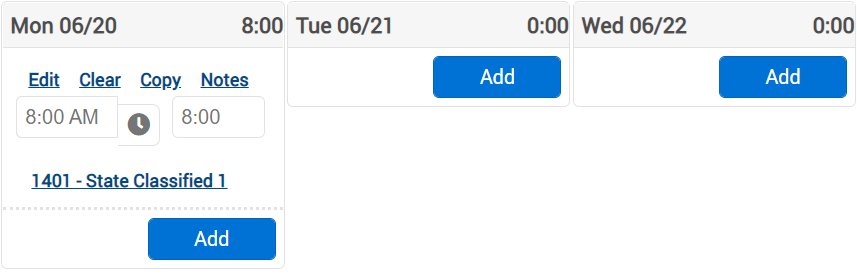

Previous timesheet quick calendar entries

Previous full detail entry screen (after clicking Edit)

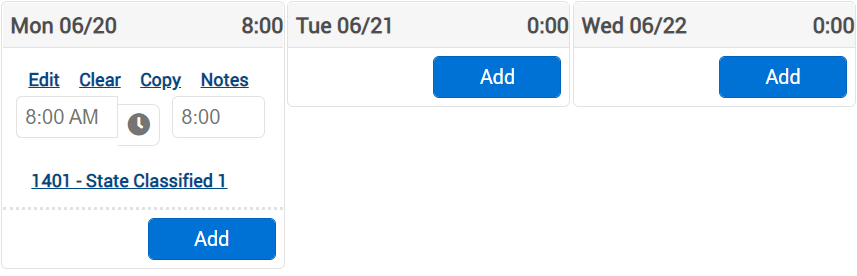

Time-in/time-out timesheet quick calendar entries

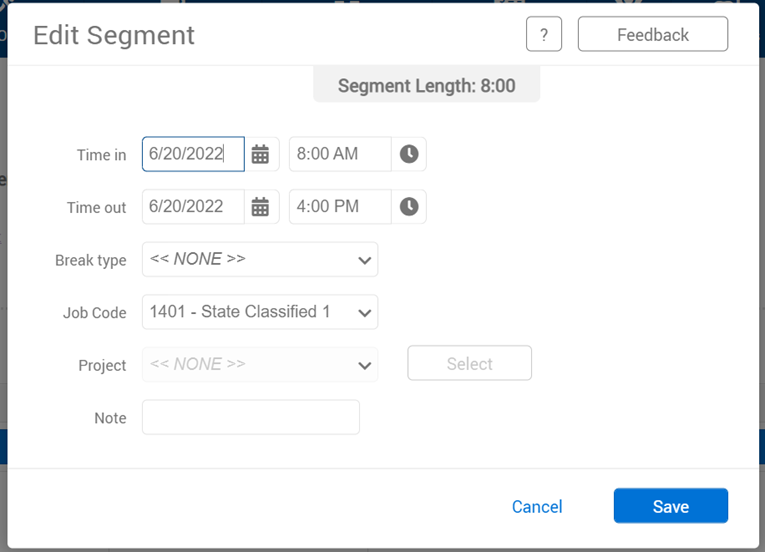

Time-in/time-out full detail entry screen (after clicking Edit)