CSU’s FAMLI Program

The University has received approval from the state of Colorado to operate its own self-funded private FAMLI plan in lieu of participation in the state’s FAMLI plan.

All benefits will be administered and applied for directly to Human Resources instead of the FAMLI division at the State of Colorado. The plan summarized below is subject to the terms and conditions of CSU’s self-funded private FAMLI plan effective January 1, 2024.

CSU’s FAMLI plan provides for a portion of an employee’s weekly salary for up to 12 weeks of leave per year to care for themselves or a family member. Those who experience pregnancy or childbirth complications may receive an additional four weeks. FAMLI income replacement benefits are primary to any other leave program, like parental leave and short term disability and runs concurrently with Family Medical Leave (FML) and any other leave program to mitigate duplication of income replacement benefits.

How can I learn more about CSU’s FAMLI program?

The division of Human Resources benefits team will host educational webinars via Zoom for employees and HR Professionals to learn more about the University’s FAMLI program.

- Recorded Zoom Presentation for Employees (Dec 14 session)

- Email: HR_leave@colostate.edu

- Phone: (970) 491-6947

- Secure Upload for documentation

CSU's Private Plan

CSU opted to not participate in the State’s plan to maintain the ability to efficiently and accurately process income replacement benefits through our internal payroll system and report on the form W-2. The ability for Human Resources to administer the plan will allow coordination of FAMLI leave with other CSU leave programs. FAMLI program benefits replace a portion of an employee’s wages. Other CSU leave programs for eligible staff can be used to achieve full pay of an employee’s average weekly wage. Other university leave programs will vary based on your employment type.

The FAMLI law requires a payroll tax of 0.45% on each employee’s wage to fund the new paid leave for employees. The university is also required to pay half of the cost of the leave program (an additional 0.45% of each employee’s wages, as defined by FAMLI). The contribution amounts are subject to change annually as determined by State law.

The FAMLI tax is paid by employees working and living in the state of Colorado.

Effective January 1, 2024, the definition of FAMLI “wages” will mean “gross wages” and will include typical components of employer compensation. In other words, the amount that is listed on an employee’s pay stub as “gross wages” will be the amount used to calculate the FAMLI premium deduction amount (0.45% of an employee’s gross wages.) This is a change from the previous mandated calculation in 2023 which used the definition used by the State of Colorado’s unemployment insurance.

Eligibility

FAMLI is available to all employees who work and live in Colorado, including faculty, staff and student employees. Employees receive job-protection through FAMLI after 180 days of employment.

FAMLI leave is a voter-approved ballot initiative and applies to employees living and working in the State of Colorado. Any university employee who works in another state does not pay the FAMLI premium and must use their state’s family medical leave policies if such plans exist in conjunction with any other eligible university leave programs.

FAMLI will provide 12 weeks of paid leave for the following reasons:

- the employee’s own serious health condition

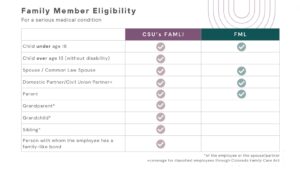

- care for a family member with a serious health condition

- care for a new child (an additional 4 weeks may be available for complications related to a birth)

- to make arrangements for military deployments

- to address immediate safety needs of domestic violence or sexual assault

Do not apply for benefits through the State of Colorado.

Employees may submit a CSU FAMLI application for benefits in advance of the absence from work, and in some circumstances, they may be submitted after the absence has begun. The claim form is available at the apply link to the right on this webpage. FAMLI leave claims must be applied for within 30 days of the first date of absence.

Applications that are considered complete with the required documentation, will be paid within two weeks after the claim is properly filed, and every two weeks thereafter for the duration of the approved leave. CSU’s FAMLI income replacement benefits follow state statute and do not follow the normal monthly or bi-weekly payroll schedule.

Any sick or annual leave or other university leave programs like parental leave and short term disability used to “top off” FAMLI will be paid in your normal payroll cycle of either bi-weekly or monthly as these follow normal taxation and benefits deductions. FAMLI income replacement is subject to Federal and Medicare taxation and State tax does not apply.

A FAMLI leave claim needs to be opened within 30 days after the first date of absence to be considered for FAMLI benefits. Any FAMLI claim filed between 31-90 days after the first date of absence will be considered if the employee establishes good cause for the delay. FAMLI benefits will never be issued before the first date of absence and will often be issued in arrears, going back to the first date of absence.

Employees are allowed 12 weeks of partial CSU FAMLI wage replacement on a rolling forward calendar year for qualifying eligible reasons. This means that an employee is eligible for 12 weeks from the first date they use leave, 12 months later. Be aware that State Classified staff use the rolling backward tracking method for FML, so the tracking for FAMLI will differ. If leave is being used intermittently, a new application will be required after 6 months.

An employee may use continuous leave, reduced work schedule, or intermittent leave for all FAMLI qualifying reasons including care and bonding of a child.

You must take leave on the schedule you applied for. Any deviation from this schedule will require a new application.

- Continuous: A specific period without any interruption.

- Reduced: The same reduced schedule over multiple weeks.

- Intermittent: Periodic or unscheduled leave within a six-month period.

Employees with an employment frequency of less than 12 months, may apply for CSU FAMLI during the period of their paid contract status. This applies to 9-month faculty and staff (including 9-month contracts paid over 12 months). 9-month employees are not eligible to begin CSU FAMLI benefits until they are in a “paid status”. In addition, employees on a suspended assignment and ineligible for pay are not active employment categories.

Yes, once you have worked for the same employer for at least 180 days (about six months), your job is protected under the law. That means you are entitled to return to the same position, or an equivalent position when your leave ends.

The laws for Job protection under FAMLI are not identical to the federal law, Family and Medical Leave (FML). More information on FML and job protection is located on our FML website.

Benefits and pay

Yes, employees may consent through the CSU FAMLI application to allow use of sick and/or annual leave to top off the FAMLI income wage replacement up to their calculated average weekly wage using the base calculation method. The base calculation method required for the CSU FAMLI plan looks to the first four of the last five completed calendar quarters immediately preceding the first day of the individual’s benefit year in relation to the average weekly wage for the State of Colorado.

Eligibility for any other related leave programs, like parental leave or short term disability, will automatically be applied to the “top off” methodology by the Human Resources benefits team.

As soon as the claim and all required supporting documentation are considered complete by the Human Resources benefits team, you can expect to receive the CSU FAMLI wage replacement every two weeks, which is based on the date the claim is complete.

Any sick and or annual leave, or leave associated with other university leave related programs to “top off” FAMLI income will be paid in the frequency of your normal payroll cycle, either bi-weekly or monthly, based upon your employment category.

By state statute, FAMLI payments are exempt from state taxation and retirement plan contributions, whether mandatory plans or voluntary plans, however, federal and Medicare tax apply. FAMLI income will be reported on your W-2 you receive from CSU. Any Parental leave or leave accruals used to “top off” FAMLI are subject to normal taxation deductions from wages and will be subject to normal retirement contributions and insurance premium payments. Keep this in mind if you are actively enrolled in a voluntary retirement plan as you may wish to lower your contributions during periods of FAMLI leave.

Yes, there is a minimum claim reimbursement of at least 8 hours. Absences of less than 8 hours may be approved, but wage replacement benefits will be paid after the 8-hour threshold is met with each claim and each recertification period.

Yes, if an employee’s regular work schedule increases/decreases during FAMLI leave, adjustments will be made to the income replacement. It is the responsibility of the claimant to inform CSU Human Resources at HR_leave@colostate.edu.

FAMLI pay is an income replacement benefit that is not subject to retirement contributions from the employee or employer. If you are a PERA member in the defined benefit plan, this means during periods of receiving only FAMLI income replacement service credit is not earned.

Employees in the Defined Contribution Plan (DCP) or the Student Employee Retirement Plan (SERP) also do not make retirement contributions on FAMLI leave income.

Half-time or greater faculty, administrative professionals and non-classified staff accrue sick and/or annual leave based upon their appointment type. Leave does not accrue on FAMLI income replacement benefits, however, if you choose to “top off” FAMLI with sick or annual leave you will accrue leave based upon the leave hours you are being paid.

Employees earning leave through the Healthy Families and Workplace Act accrue leave on hours worked. 1 hour of accrued, paid leave per 30 hours worked, up to 48 hours a year.

You must be an active employee in paid status to apply for CSU’s FAMLI program. If you are on a reduced work schedule or intermittent leave, FAMLI leave ends upon termination or the end of the contract period and a new application can be submitted upon rehire or the beginning of the next contract period. Employees on continuous FAMLI leave are eligible through the duration of the approved leave.

Employees on continuous FAMLI leave will receive income replacement from the CSU FAMLI program. The fact that a holiday/break may occur within the week taken as FAMLI has no effect; the week is counted as a week of FAMLI leave. This assumes the employee began leave during a period of work and the leave begins before the holiday or university break.

If an employee is using FAMLI leave in increments of less than one week, the holiday/break will not count against the employee’s FAMLI entitlement–and the employee will not receive wage replacement benefits from FAMLI. The normal leave code would be used for holidays if they would normally receive holiday pay and not be working.

How much will my benefit be?

Benefits are calculated on a sliding scale, up to a weekly maximum benefit currently set at $1,100. The monetary calculation for FAMLI uses a base period of the first four of the last five completed calendar quarters immediately preceding the first day of the employee’s benefit year, in relation to the average weekly wage* for the State of Colorado.

The weekly benefit is 90% of an employee’s average weekly wage, if it is equal to or less than 50% of the state’s average weekly wage (indexed annually). Then, for any portion of the employee’s wage greater than 50% of the state’s average weekly wage the calculation is 50% of your remaining average weekly wage up to the $1,100 weekly maximum.

*The State’s average weekly wage is subject to change annually by the State of Colorado.

| Examples of Benefit Payments* | |||

|---|---|---|---|

| Weekly Wage | Weekly Benefit | Max Annual Benefit | % of Weekly Wage |

| $500 | $450 | $5,400 | 90% |

| $1,000 | $784 | $9,408 | 78% |

| $1,500 | $1,034 | $12,408 | 69% |

| $2,000 | $1,100 | $13,200 | 55% |

| $3,000 | $1,100 | $13,200 | 37% |

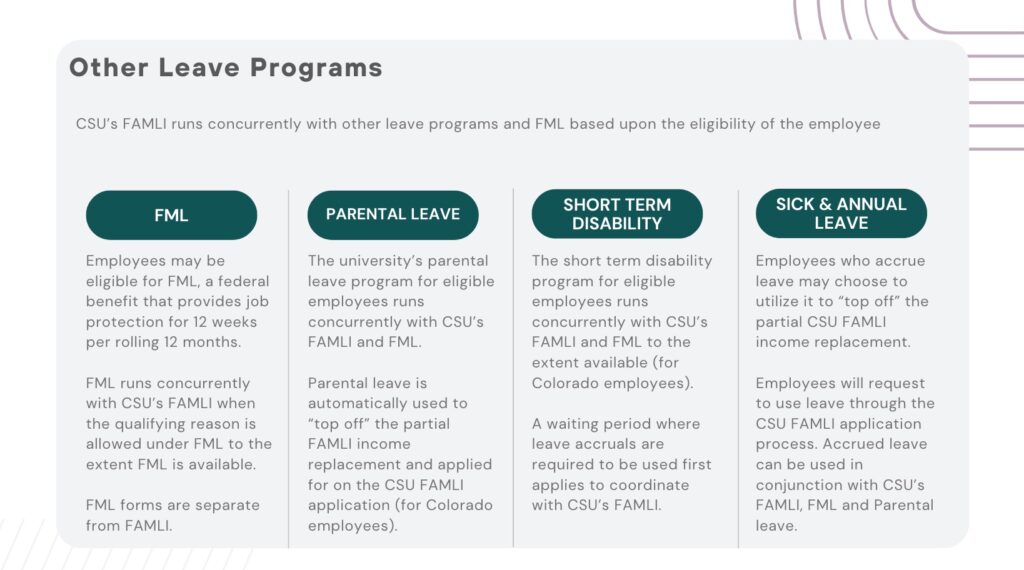

Coordination with other leave programs

Employees are not entitled to duplicate FAMLI wage replacement benefits with employer provided paid leave programs. With mutual agreement of the employee, CSU FAMLI will allow use of accrued leave or other paid leave programs to supplement the FAMLI income replacement by “topping off” the partial income replacement up to the employee’s average weekly wage. If an overpayment occurs for the same hours, the CSU FAMLI will remedy the overpayment with a reversal through payroll.

Yes, new parents are eligible to apply for CSU FAMLI leave to bond with a new child anytime within the first 12 months after a birth, adoption, or foster care placement. New parents will have some weeks of eligibility in 2024 depending upon the date the child arrived in 2023 even if other CSU leave programs or FML were used. This is a transition rule built into the FAMLI statute.

For example, if an employee became a new parent on February 1, 2023, they could apply for CSU FAMLI leave beginning January 1 – 31, 2024, at which time the 12 month requirement would end.

Any use of other CSU leave programs in 2023 do not duplicate in 2024 for “topping off” FAMLI partial income replacement. Any sick or annual leave accruals would be eligible to “top off” FAMLI if you consent to their use when applying.

Yes, special documentation is needed, and it varies based upon the leave type. These documents are required and separate from any submission made for FML, short term disability or insurance purposes.

- Serious health conditions – the FAMLI serious health condition form is filled out by the treating licensed health care provider.

- Leave taken for birth/adoption/bonding – Bonding Statement is required along with one of the following:

- a birth certificate, birth certificate worksheet or vital records document

- in loco parentis status statement

- proof of adoption placement from a court or adoption agency, or

- child placement agency for foster care.

- Faculty and non-classified staff may qualify for up to 12 weeks (480 hours) of unpaid FML per rolling 12 month period (measured forward) as long as the duration of employment is at least 12 months within the last 7 years and has worked at least 1,040 hours during the most recent 12 month period prior to the commencement of the requested leave. Faculty members or administrative professionals with regular or special 9-month appointments of half-time or greater are deemed to meet the 1,040-hour standard as long as all other eligibility criteria are met.

- Classified staff may qualify for up to 12 weeks (480 hours) of unpaid FML per rolling 12-month period (measured backwards) if the staff member has 1 year of state service as of the commencement of the requested leave. Classified staff are eligible for 1 additional week (40 hours) of State family medical leave to be used after the use of leave under FML.

- FML is pro-rated for part-time employees.

- FML and FAMLI run concurrently for all qualifying reasons that meet the definition of each law.

State Classified

State classified employees who are eligible for short term disability through the State of Colorado’s plan administrator, UNUM, will automatically receive a benefit reduction based on the expected FAMLI income replacement they “could receive if they applied” for FAMLI (to avoid overpayments). FAMLI runs concurrently with short term disability. If you receive greater than 60% wage replacement from FAMLI, short term disability may provide job protection but no additional pay. If you receive less than 60% FAMLI wage replacement, short term disability will pay benefits up to only the 60% and cannot be used to “top off” FAMLI. It is a good idea to apply simultaneously for both program benefits or a delay in income replacement can be expected.

Revised April 2024: A state classified employee may choose to use or not use PFML with FAMLI as determined by the State of Colorado.

Safe leave allows use of PFML even if FML has already been exhausted.

Accruals of sick or annual leave do not accrue on FAMLI income replacement benefits, however, if you choose to top of FAMLI with sick or annual leave you accruals will continue in accordance with state rule based upon your FTE if you choose to ‘top off’ with FAMLI.

FAMLI Forms

- Care & Bonding Statement

- Proof of birth (copy of birth certificate, application for a birth certificate, etc.) also required.

- Medical Certification

- Safe Leave

- Military Exigency Leave